Drake Hampton

Mar 23, 2022 17:03

Forex day trading is a common strategy for trading currencies on charts with a shorter timeframe horizon. Continue reading to learn more about day trading forex, how to incorporate it into a plan, and how to manage risk successfully.

Forex day trading is a strategy for trading currencies on an intraday basis, employing charts with a shorter time horizon (for example, 15-minute charts). Traders maintain positions over a period of minutes to hours, sometimes with the use of technical tools that aid in determining entry and exit locations. It is a kind of trading that needs concentration and discipline in volatile markets.

A day trader's timeframe is shorter than that of a position trader, who may have a position open for many months or even a year, or a swing trader, who may hold a position for a few weeks. It is, however, lengthier than a scalper, who exits a deal within minutes, if not seconds.

There are several distinctions between forex and equities for day trading. Here's a huge one: because day traders' holdings are not maintained overnight, they are typically unaffected by fundamental events such as specific news events that might alter prices before or after the market opens or closes.

However, because forex is a 24-hour market, fundamentals may alter price movement at any moment, and traders employing a strictly technical strategy should be aware of this.

Other critical differences between day trading forex and day trading equities and other markets include leverage levels, trade volume, and accessibility. Additional broad distinctions between forex day trading and stock day trading for US traders are shown below.

To begin day trading forex, individuals must first recognize that this is a difficult effort that demands rigorous planning. To increase their chances of profitability, traders must be aware of the currency markets' blend of fundamental and technical factors, as described previously. However, players must begin with adequate funds to avoid blowing their account. Forex trading is not for everyone.

This varies by individual, but although a few hundred dollars may be adequate to try with a real money account, a larger account size may provide a more lucrative possibility that compensates for the effort invested.

Additionally, traders must verify that they will have access to the charts for the duration of the time they want to spend trading each day. An unplanned journey away from the computer or mobile device, regardless of how brief, might result in the loss of critical information about price action.

Crucially, traders must understand the risks involved and implement a risk management strategy to mitigate them as much as possible. This implies trading no more than a predetermined proportion (say 1% or 2%) of their available money every day, starting small, using well-considered stops and limits, and adhering to a strategy.

A profitable forex day trading strategy may entail up to five trades each day, each lasting between a few minutes and a few hours. There are several tactics available, but regardless of the strategy, day traders should aim to trade during the most liquid hours, between 8AM and 12PM ET, when the US and London markets overlap.

Prior to initiating a position, it is critical to ascertain the market circumstances in which the strategy will operate, as different timeframe research can provide a more comprehensive view of price activity. In the following example, 20 and 50-period EMAs are utilized on a one-hour chart to determine the direction of a larger trend with the purpose of opening and closing positions on a 15-minute chart.

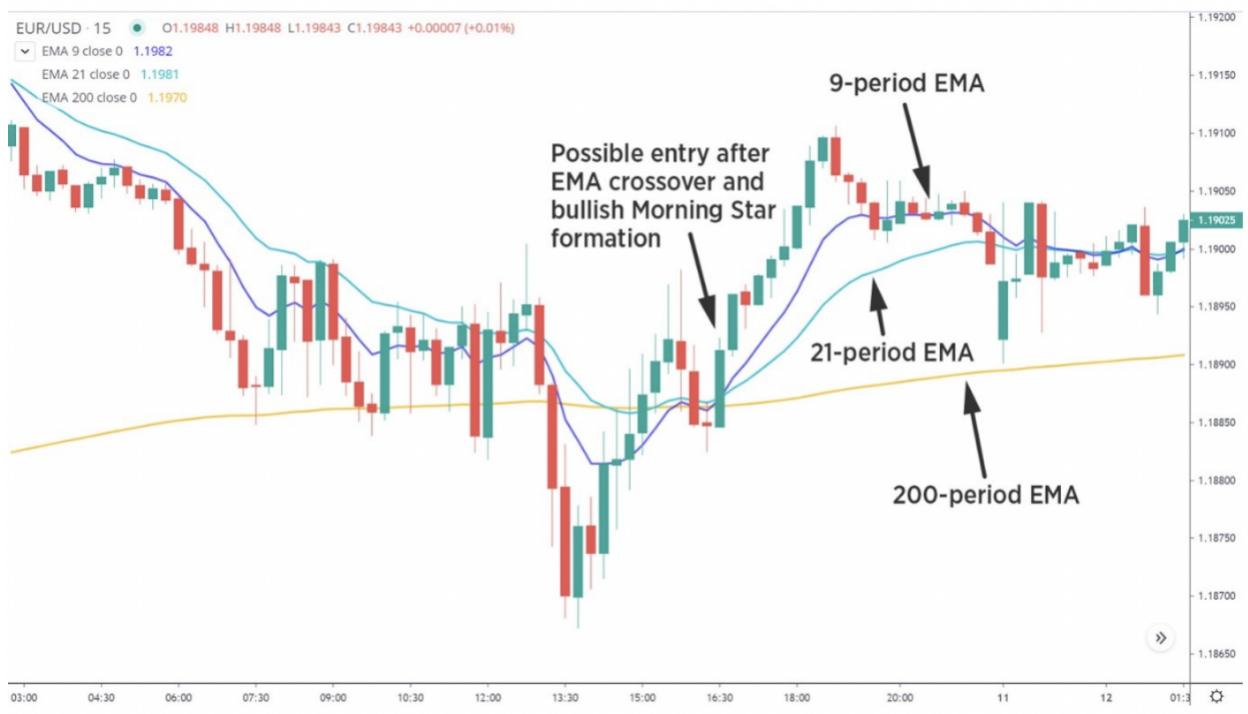

We'll examine a basic moving average crossover method in the example below. When the 9-period EMA crosses over the 21-period EMA and the price is above the 200-period EMA, a trader may go for longs. On the other hand, short positions may be placed when the 9-period EMA crosses below the 21-period EMA, as well as when the price falls below the 200-period EMA.

Here, a long green candle closes above the 200-period exponential moving average, coinciding with a bullish EMA crossover, indicating a solid long entry point.

A tight stop may be put immediately below the crossing, while a more aggressive stop might be placed farther down near the previous swing low. However, a stop that is too tight may cause a trade to close prematurely, while a stop that is too far away may cause losses to compound fast. Traders can eventually strike a balance that suits their style.

When considering entering such a trade, you should establish a profit objective. Some traders want a profit objective of two times the risk before exiting, while others wait for a bearish crossing to occur; nevertheless, the market does not always make large changes, and a bearish crossover signaling an exit may not occur when you want it to. A goal of 15-20 pips and a stop right below the EMA crossing might result in a risk-reward ratio of about 1:3.

While this example utilizes moving averages, there are an infinite number of different day trading strategies and technical indicators available, including Fibonacci retracements, MACD, and RSI. Each of them may provide unique insight into overbought and oversold levels, as well as critical support and resistance zones.

Along with trend trading, day trading tactics may be applied to range markets, in which price generally moves in one direction. This might result in a more neutral approach than in moving markets, with traders considering both buy and sell positions near support and resistance levels.

Breakouts, when price breaches an established support or resistance level, may also provide new impetus and the possibility of huge pip changes, which can be thrilling for day traders as well.

Day trading forex has risks, which is why effective risk management is critical.

Trading highly liquid pairs at periods of high volume might be critical on short-term charts.

Multi-timeframe research can assist in providing a'more complete picture' of market activity.

Technical indications can aid in entry and departure decisions, particularly in the case of confluence.

Maintain constant attention to the charts!

Mar 23, 2022 16:23

Mar 23, 2022 17:14