With many hundreds of Coypto brokers to choose from globally, finding the right broker for you can seem an impossible challenge. That's why we at DailyForex keep our team of industry analysts at work, to make choosing the best broker easier for you.

Summary

Highly regulated, choice of fixed or floating spreads.

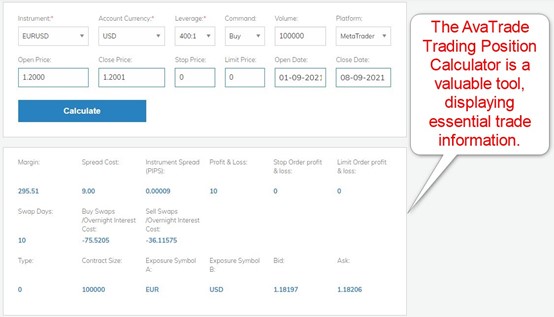

Besides services by Trading Central, ideal for beginner traders and those unable to conduct broad-based market analytics, I like the Trading Position Calculator AvaTrade maintains on its website. It presents an excellent risk management tool, provides vital trading information, and allows traders to plan and maintain their portfolios.

Another fact I want to note is the superb transparency at AvaTrade, which ensures all necessary information for each trading instrument is publicly available on its website.

| Country | Ireland |

| Regulation | MiFID, Central Bank of Ireland, FSA, ASIC, BVI, FFAJ, FSCA, ADMG - FRSA |

| Year Established | 2006 |

| Leverage | 1:400 |

| Minimum Deposit | $100 |

| Broker Type | Market Maker |

| Platform Type | MT4, MT5, WebTrader, AvaOptions, AvaTradeGO, Ava Social |

Summary

Award-winning proprietary trading platform alongside MT4.

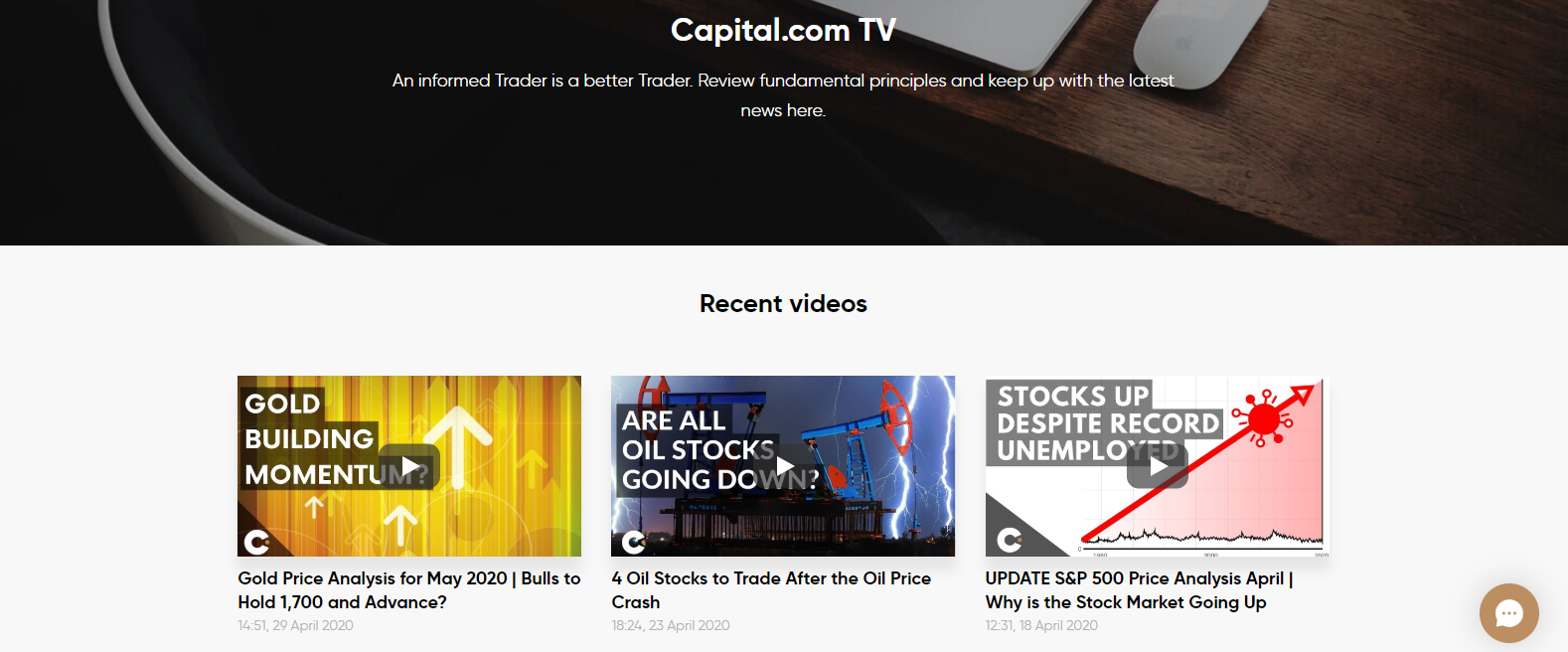

This broker does not provide unique features of any significance. What it does do, however, is focus well on its core trading environment; in that respect, it exceeds that which is currently offered by many of its competitors. For example, warranting a notable mention, Capital.com TV is filled with excellent videos that cover a wide range of trading-related content. It presents an outstanding auxiliary trading service and offers clients an informative break from regular day-to-day operations. Many brokers offer video services, but this one is certainly a good one. Additionally, it provides trading ideas related to current events. Capital.com TV is a comprehensive service for traders to consider, even if they are not clients of this brokerage.

Capital.com TV is an outstanding auxiliary service maintained by this broker.

| Country | Cyprus |

| Regulation | FCA, CySEC, NBRB |

| Year Established | 2017 |

| Leverage | 1:30 retail, 1:500 professional |

| Minimum Deposit | $20 or a currency eq |

| Broker Type | Market Maker |

| Platform Type | MetaTrader 4, Proprietary platform, Web-based |

At DailyForex, we have assembled a team of expert traders who have experience in trading their own money with retail online Forex / CFD brokers to conduct an overall assessment of what is on offer in this space. They examined the 100 most well-established brokerages offering trading in individual stocks, and gave most weight in their assessments of each concerning cost of trading, reliability of execution, and internal and regulatory client protection, while also giving some weight to additional features offered by each broker, mostly concerning ease of use and customer service.

We ranked more than 100 Forex brokers. Each broker was graded on at least 50 different variables and, in total, over 100,000 words of research were produced.

The result is a finalized rating for each broker.

Let us be clear – opening an account and making a deposit at a Forex broker is something you should take seriously. You are putting some of your capital in the hands of a company, and in return, you should expect them to provide the tools you need. The more money you deposit as a percentage of your net liquid worth, the more careful you need to be. You should also expect that your deposit (and profits) will be kept in safe custody, and you want to know that that you will be able to make a speedy withdrawal.

Our first concern in reviewing a broker is the integrity of the firm, the soundness of their business practices, and the quality of the regulatory framework which they work under. After all, if you find a broker is not to your liking, there is little damage done if you are able to close your account.

Our second priority is determining whether a broker gives value for money to its customers in return for the services it provides. This is measured mostly by the cost of trading, in spreads, commissions, overnight swap rates and other incidental fees. Of course, generally, the more money you deposit, the more you can expect from your broker in return.

After dealing with bread and butter issues, our Forex broker reviews assess how each broker measures up in terms of the range of assets offered for trading, maximum leverage offered to traders, spread and commission models available (e.g. fixed vs. floating), and choice of trading platforms. Finally, we might consider the “bells and whistles” which are a relatively unimportant part of any broker’s offering, such as educational materials and bonuses and promotions.

A good Forex broker should offer consistently good liquidity and smooth execution, which are the mainstays of smooth trading conditions. This is because trading is easiest in such conditions, and loss causing events such as slippage less likely. Liquidity can of course shorten at certain times of the day, making spreads wider at certain time. No broker can be expected to provide narrow spreads just before a major news announcement. Yet generally, entering and exiting trades should be easy, without any glitches or platform freezes.

Probably the most important factor here is, will you be able to trade everything you want to trade? If you are only interested in the major Forex currency pairs, that will be easy, but if you really want to trade individual stocks and shares, or say, the less common commodity offerings, you will find that not all brokers offer them, although most offer some of them wrapped as CFDs. There is nothing wrong with being diversified, but you should keep in mind that the cost of trading such relative rarities tends to be higher than the cost of trading Forex. Also, you might consider opening accounts with two different brokers, as you could find that there is not one perfect solution but there might be two.

For various reasons, some Forex / CFD brokers will not allow residents or citizens of certain countries (most often, the U.S.A.) to open accounts. This means that depending upon where you live and what nationality you have, you may not be able to access certain brokers.

A good Forex broker you also must be affordable. This means that you can afford to meet their minimum deposit, although there are many brokers here requiring a minimum deposit of only $10, and in some cases, imposing no minimum deposit at all.

If there is really nothing between your shortlisted brokers, and one has a nicer trading platform, or offers some better minor condition somewhere, then why not let that break the tie? Remember, it is easier to get used to a trading platform you do not initially like, than it is to get used to a broker who gives you a bad overall deal. Unfortunately, many new traders get hung up on small things like trading platforms and bonuses. These are relatively unimportant.

Almost every Forex broker offers their own mobile trading app. This can be useful if you intend to ever trade using a handheld device. Most traders probably do find themselves checking up on trades while they away from their desks, so you will might want to download a broker’s mobile trading app and see how you like using it with a demo account, when you are in the process of deciding which broker to open a real live money account with.

Deposits and withdrawals are usually nothing to worry about, except in a few rare cases. A broker that will not speedily send you funds which you have requested and are in your account, raises a big red flag, and is to be avoided at all cost. Deposits are made speedily almost everywhere, for obvious reasons. Occasionally, you may wish to use a payment method which a broker will not accept, for some reason. You will have to find another payment method or another broker which accepts your preferred payment method in such a case.

Examine the reputations of the brokers making your shortlist, one by one. A quick google search can determine if they have ever been fined by their regulator for a breach of rules, and which rules were breached. Are they a public company? Does their financial position look healthy? Have they been in business a long time? There are plenty of newer Forex brokers which are perfectly sound but using longevity can be an effective rule of thumb.

Your first step in seeking the best Forex brokers is to restrict your search to include only the brokers you feel comfortable trusting as a custodian of your money. Ideally, you should only be looking at regulated Forex brokers, and it is advisable strongly consider the stronger financial centers such as brokers regulated in the U.S.A., brokers regulated in the U.K., or brokers regulated in Cyprus. Consider also whether you would be in a stronger position choosing a Forex broker regulated in the same country in which you live: in the event of any dispute with them, you could be better placed to pursue it more effectively. Alternatively, you could focus on the offshore center which has the strongest relations with your country of residence – for example if you live in the European Union, you might find it easiest to choose a Forex broker in Cyprus, another E.U. member state. Don’t forget that some regulators, mostly the stronger ones, may be prepared to pay back all or part of your deposit if one of their brokers go out of business. It is not wise to rely upon the promise of “segregated accounts” to protect your funds from broker bankruptcy.

This is a relatively minor consideration because the vast majority of retail Forex / CFD traders will never need to use customer support. However, in the case of a problem or emergency, you will want to know that at least a fairly competent customer support team is there ready and able to help you. It could be a good idea to give them a call if you can find any question with your demo account, just to test out how good your potential broker is in this department.

As mentioned previously, a quick google search can tell you all about a broker’s corporate background and history, including any trouble they may have got in with regulators for breaches or omissions of appliable regulations.

The majority of Forex / CFD brokers offer free trading education. This really is not important, because the internet is full of free Forex education anyway, so you do not need to worry about getting it from your broker. Worry about their trading fees, execution, reliability, and regulation instead. Many brokers offer very low-quality educational materials as a sales gimmick.

Almost every Forex / CFD broker makes it as easy as they possibly can to sign up and open an account, of course, as it makes good business sense to do so. With many brokers, you will be able to get an account registered and opened, ready to receive your deposit, within a day of submitting your online account-opening form. To some extent, this will depend upon which regulatory regime the broker is subject to, and which country you, the client, is resident in.

Check the minimum deposit each potential broker requires from you in order to open your account. This can range from $10 at the low end to as much as $10,000, although fortunately most brokers accept clients willing to deposit as little as $100 or perhaps $200.

Deciding how much money you should deposit with a Forex broker is also important. Not only should you only deposit funds which you can afford to lose, it is also worth considering whether all the funds you can afford to lose should be in the custody of only one broker. You could consider splitting the amount in half and opening accounts with two different brokers, for example, as an effective way to limit your overall risk as a trader. There can also be other valid reasons to do this, for example, you might want to trade stocks with broker A and forex with broker B because their respective offerings in each differ in quality.

Keep in mind that generally, the more you are prepared to deposit, the better deal you are going to get. Many brokers offer a lower cost of trading (e.g. cheaper spreads, etc.) to anyone depositing more than say $500, $1,000, or $10,000. You should never deposit more than you can afford to lose with a Forex broker, but it is another factor worth considering.

Some brokers do not allow scalping (opening and closing trades within just a few seconds). There are plenty that do. If you are set on being a scalper, it is something you will need to check you can do.

Forex brokers typically advertise themselves as one of the following: ECN brokers, STP brokers, or market-makers. Some brokers claim they are a hybrid of two of these. Some traders are very keen to deposit with ECN brokers because they think the cost of trading will be less or that this model makes the broker more honest somehow. The truth is more complicated: each execution method has both potential advantages and disadvantages. Another problem is that there seem to be quite a few brokers claiming to be ECN brokers, but it is hard to believe that they really all are true ECN brokers when viewing their conditions of trading. Some brokers offer all the major options in different account types. The bottom line is, it is worthwhile doing some research on the different models and seeing whether one really makes sense for you, or whether in practice there will be little difference.

Advertisement

See for yourself why ECN brokers are so popular!

The best Forex trading platforms are widely held to be MetaTrader 4 and cTrader, although many brokers have their own unique proprietary platforms that are arguably as good.

Almost every Forex broker offers the use of the MetaTrader 4 trading platform, although cTrader is less common.

It is a fact that choice of trading platform is not really that important, although traders will have their favorites based mostly upon the intuitive usability of the platform.

If it is a deal-breaker for you and you are set on one of the less common Forex trading platforms, this could restrict your choice of broker, so you would be well-advised to try to be flexible here in this case.

The most important fees charged by brokers are spreads and commissions applied to every trade you make, but there are other, more hidden fees as well.

Overall, we feel that the best Forex brokers for low costs are FXTM and Pepperstone.

Examples of more “hidden” fees worth looking into include such fee types as overnight financing charges on open trades, otherwise known as swaps, which are charged by every Forex / CFD brokerage we have ever seen. If you will be keeping positions open regularly past 5pm New York time, you will probably be charged a small fee based upon an interest rate and the size of your open trade. Unfortunately, these fees fluctuate in line with money markets so they can be difficult to assess, but you can compare the rates charged on the same day by different brokers and see which one offers a better deal. Some brokers publish these rates on their websites and update them daily as they change. Others are less transparent, but you can typically find the rates in their trading platforms, although demo accounts may not reflect the true rates offered. A few brokers also charge account inactivity fees, and some charge withdrawal fees in addition to the cost of the withdrawal method which may apply. It is worth considering how often, how much and how long you expect to be trading, to get some idea of the total fees you will be paying each broker you are considering depositing with.

“International Forex brokers” are brokers outside the U.S.A. who offer account services to U.S. residents and nationals. We have published a listing of the best international Forex brokers.

While the majority of our listed Forex brokers focus on catering to customers resident in OECD nations such as the U.S.A. and the U.K., in our listing of international brokers you can find brokers that offer their services to clients from Pakistan, Ghana, Kenya, Namibia, Zimbabwe and many other developing nations.

Some Forex brokers will claim to provide their clients with “research” about the Forex and CFD markets, in the same way major banks provide similar to their high net worth clients.

You are unlikely to receive any true “research” except from the biggest brokers, or at least, from those brokers requiring relatively high minimum deposits of $10,000 or thereabouts.

In other cases, offers of “research” are likely to be a marketing gimmick.

If you are getting good research, it might be comparable to a paid “squawk” service in quality, although probably it will not be as time sensitive.

Quality of research should probably not be a major factor in your choice of broker.

All you need from your Forex broker is to have adequate customer service, because you will probably never need to use a broker’s customer service department. There is no reason to choose a broker just because it might have the very best customer service.

Having said that, if the level of customer service is really important to you, we know that FXTM excels in this area as a result of conducting random test calls. Their customer service representatives are prompt and responsive, and they offer support in a range of languages which is almost unparalleled by any other Forex broker.

Practically every Forex broker offers a trading app so you can trade with them from any mobile or handheld device with internet or 4G connectivity. Some apps are especially popular as trading intelligently from a portable device can be challenging in that user environment. Of the five brokers listed here, the apps that are seen as most helpful and therefore get the best reviews tend to be FXTM and AvaTrade. In particular, AvaTrade’s app offers some really quite unique features.

Day traders do not have to worry about swaps (overnight financing fees) because day traders rarely hold positions open over 5pm New York time when they are generally charged or paid. Instead, day traders need to be especially concerned with swaps and commissions, because day traders will often be making a relatively large amount of trades. The best brokers for day traders tend to be those that do not impose minimum trade times over which any open trade must be held – this can be shocking, but some brokers do this, so check the small print on their sites carefully. Finally, brokers suiting day traders will have no problem with scalping, and will offer very competitive spreads and commissions – very often, these will be ECN Forex brokers.

After safety of deposit, this should be your second or perhaps third consideration in choosing a broker. Your cost of trading will impact your profitability, so this is very important. Choose a broker that offers competitive spreads. As a good benchmark, any broker charging more than 1 pip as an average spread on the benchmark EUR/USD currency pair is probably not going to be competitive here, even when all issues are considered.

Keep in mind that the spreads you see when you are paper trading a broker’s demo account will not necessarily match the spreads offered in real time in a comparable live account.

Most brokers today offer trading in Forex with a minimum trade size of only 1 micro lot in a micro account. A micro lot is 1% of the size of a standard lot (typically 10,000 units of the denomination currency). This means that brokers offering micro accounts make it possible to trade with quite suitable, conservative leverage and money management, even with a deposit of only approximately $100 or equivalent. This is great news for smaller depositors, but they should still be sure to check their favored brokers do allow trading in micro-lots.

Most brokers publish on their website a list of all the assets the offer their clients the ability to trade. You will of course always find the major Forex pairs there, but the more minor pairs and crosses, not to mention the exotic currencies, are a little rarer.

There is no reason why Forex trading cannot be profitable with just a handful of major currency pairs. However, some traders may require a very diversified trading style, or might wish to trade particular exotic currencies. If you fall into this category, it is worth searching through your shortlisted broker’s websites and checking exactly which Forex pairs and crosses are on offer.

Most Forex brokers are not just selling the ability to trade Forex but are also offering trading in CFDs covering commodities and major equity indices, and sometimes also individual stocks and shares. There are even a few brokers, including some of the ones listed here, offering more unusual products, such as the Forex options offered by AvaTrade.

It is practically unheard of for any Forex broker not to offer a demo account. This means that if you are considering opening a real money account with any Forex broker, you can try them out first in something approximating real conditions by opening a demo account with them, in which you trade imaginary funds in real market conditions, albeit without real liquidity and execution issues.

Forex brokers invariably offer leveraged trading, meaning a client can trade with more funds that they have actually deposited.

The exact amount of leverage offered is partly up to the broker, although each different regulatory regime imposes different maximums on different types of assets.

Forex is usually the most highly leveraged offering.

Basically, the very highest leverage is offered by the least regulated or unregulated Forex brokers, often at 1000 to 1 or even higher. This is far more leverage than anyone could ever need.

Forex brokers usually publish the details of the maximum leverage offered. There is no obligation to use it – even if your broker is offering you lots of leverage, you do not need to take it.

Traders looking for brokers with unusually high leverage will have to make a point of checking this, but for most traders, it should not become an important issue.

Some brokers regulated outside the European Union offer bonuses to new depositors, which usually take the form of adding funds to the account.

If this sounds too good to be true, that is because it usually is – read the small print, which generally stipulates that bonuses cannot be withdrawn until the funds have been used to make a large number of trades. This means that bonuses are mostly not only a marketing device but may be used to encourage clients to over trade and delay withdrawing profits.

It is probably most worthwhile ignoring bonuses completely.

Almost every Forex broker today offers the full range of order execution types. However, there are two in particular worth checking which can be especially useful for some trading styles: trailing stop, and OCO (“one order cancels the other”).

Some brokers offer a reporting function which can be useful when you are writing your tax return at the end of the year if you have profits or losses to report. This is probably most useful for U.S. persons who are subject to fill in highly complex tax returns.

Traditionally, brokers were either ECN or market-making brokers. Today, many brokers offer a choice between the two as different account types. Many brokers also tend to offer a wide range of different account options, which offer better deals depending upon how much you want to trade, and what trading style you tend to utilize. Therefore, it is worth reading the various options carefully and considering what best meets your requirements as a trader.

Unfortunately, the Forex industry has historically suffered from scammers setting up unregulated or extremely lightly regulated brokers. These scam brokers tended to use a range of tricks to make their clients lose money, or to make it very difficult for clients to withdraw any funds they deposited.

We have taken care to ensure the brokers we list do not fall into this category.