Haiden Holmes

Feb 25, 2022 16:41

After-hours trading takes place outside the common hours during which a stock market (such as the Nasdaq or New York Stock Exchange) is open. This trading can fall under post-market trading, which happens between 4:00 p.m. and also 8:00 p.m., or pre-market trading that takes place in the morning before 9:30 a.m. A monetary advisor could be much better equipped to help address any kind of questions concerning exactly how after-hours trading as well as investing may suit your bigger financial goals and strategies.

To make use of after-hours trading, you will certainly require to recognize what the routine market, pre-market, and also after-hours session hrs are for your picked exchange. The hrs for trading for both the New York Stock Exchange and also NASDAQ are as follows:

Normal trading: Weekdays from 9:30 a.m. till 4:00 p.m. ET

Post-market trading: Weekdays from 4:00 p.m. until 6:00 p.m. ET

Pre-market trading: Weekdays from 9:00 a.m. till 9:30 a.m. ET

A few.

Sadly, order types are limited when you make a decision to trade the marketplace after-hours. Please note, you can just make use of limit orders for purchasing, selling, or shorting. As well as prior to I neglect, if you such as to position customized orders with unique problems, you may be let down.

Below you'll see a list of professions you won't be able to implement after-hours:

Fill-or-Kill Order: a conditional kind of time-in-force order to be totally executed right away or not in any way.

All-or-None: a direction to fill the order completely at the specified cost or terminate it. To put it simply, either market it all or offer none at all.

Immediate-or-Cancel: An order to purchase or sell that tries to execute all or part of the order right away and after that cancels any kind of unfilled section of the order.

At this point, you're most likely asking yourself why you can not implement these types of orders after hours. In spite of the versatility ECNs provide, the complex nature of the trade constraints makes them testing to execute.

Market Orders, consisting of Fractional Orders

Market orders that are put during an extended-hours session (9:00 to 9:30 AM or 4:00 - 6:00 PM ET), including fractional orders, are transformed to restrict orders with a limitation cost evaluated 5% away from the last trade price at the time the order was gotten in. This is called market order capturing. If the marketplace price remains outside the 5% collar, the order will certainly continue to be possible and canceled at the end of the after-hours session.

Not all safety and securities are eligible for market orders during extended hours. If a security is ineligible, the order will queue for the opening of the next regular-hours day session (9:30 am ET).

You can select to make your limitation order legitimate with all hrs (regular as well as prolonged) or only during normal market hrs. If the supply is readily available at your target limit cost and also the whole lot size, the order will certainly execute at that cost or much better.

Stop orders won't perform throughout the extended-hours session. The stop restriction and quit loss orders you put throughout extended-hours will queue for the opening of normal market hours on the following trading day.

Routing quit orders won't perform during the extended-hours session. The trailing stop orders you position throughout extended-hours will queue for the opening of regular market hours on the next trading day.

A Good-for-Day (GFD) order placed during the pre-market, regular-market, or after-hours session will immediately run out at the end of the after-hours session. Any type of GFD orders put while all sessions are shut are queued for the open of the next regular market hours.

A Good-til-Canceled (GTC) order put throughout the pre-market, regular-market, or after-hours session continues to be active via all sessions until it's either implemented in the marketplace, or up until you cancel it.

In after-hours trading, order types that demand instant execution are generally declined. These include "fill-or-kill" and "immediate-or-cancel" orders. They also consist of "all-or-none" orders, in which stock should be sold completely or otherwise in all.

After-hours trading is made possible by digital order matching systems called digital markets. An electronic market is simply a solution that pairs up buy and sell orders. For example, if you put an order to buy 200 shares at $45, the computer system aims to see if there is an order to buy at least 200 shares at $45. If there is, the trade is done, otherwise, then the order will certainly not be filled up. At Schwab, clients can put orders for after-market trading as well as execution in between 4:05 as well as 8 p.m. ET. Compensations as well as settlement times are the same when it comes to the normal session.

Let's say it's 9:00 pm, and you want to get 1000 shares of AMD at $80. To do so, you most definitely aren't boarding a plane to the NYSE floor to position the profession by hand.

For beginners, the market isn't also open, and also if it was, you would not also get through safety and security at the door. Consequently, after hours choices trading isn't available.

Rather, you merely switch on your computer, log right into your brokerage firm account, find the AMD ticker and also click the buy button. Your order amazingly goes into the cloud and a vendor's found. Lastly, you obtain notice that your order's filled, and also you enjoy.

You can thank the electronic matching system, or else called the digital market for that. In its simplest type, the digital market works by matching buyers with sellers.

What the ECN does is it looks for sellers aiming to sell at least 1000 shares of AMD for $80. When a match is discovered, your trade is finished. At the same time, if there's no suit, there's no profession. Among the extra factors of consideration is that lots of broker agents allow after-hours trading. So if you're bothered with not being able throughout normal alternatives market hours, fret say goodbye to.

The list is rather extensive but right here are a few of my favorites:

TD Ameritrade

Integrity

Webull-- the very best. 4am EST trading opens up. 8pm EST after hrs.

After-hours trading was once scheduled for institutional capitalists, today with the ECN capability, it is commonly offered for any level of investor. The brand-new system additionally enables institutional financiers to invest anonymously, if they select to do so. After-hours trading has actually ended up being more widely made use of in the past couple of years, and a rising variety of investors are proactively welcoming it.

For people who want in on after-hours options trading, there are a couple of special benefits.

One huge allure of extended-hours trading is the chance to communicate with foreign exchanges. A lot of these markets remain in different time zones. After-hours investors can monitor what's going on in these exchanges. International trading tasks commonly influence what happens in American markets. And also because of the various time zones, tasks in foreign markets take place after United States stock market hours. Extended-hours trading maintains you in the know. Knowing what is taking place in the international markets is essential, as in many cases, it directly influences United States market prices.

In a similar way, crucial occasions that occur after the marketplace closes can have a significant effect when the marketplace opens the next day. Foreign information, political battles, natural disasters, and various other events may not happen between 9:30 am as well as 4:00 pm. After-hours traders can react to these events and position their portfolios to stay clear of volatility. You can act swiftly to the news. For evidence, look no further than the timing of earning's releases. The majority of businesses release their revenues at the close of the regular session, which's when all the activity happens. With after-hours trading, you can place a sell reaction to the news without waiting on normal alternatives market hrs.

Most companies release their quarterly profits records after the market shuts. They do it to make sure that their relevant news will not quickly alter the supply price. But after-hours investors can obtain a get on option when revenues are revealed. They can buy a security before its price rises the next early morning or they can offer one prior to it falling low.

Some traders can not make day trades due to work, college, or other daytime duties. After-hours options trading gives them the opportunity to trade when they have time to do so.

The after-hours market is at risk of volatility. While that indicates that there's a larger danger, there's likewise a possibility for some great deals at attractive prices. With enough experience in after-hours options trading, you may be able to find a couple of.

No requirement to hide from your employer at your desk to position trades. You can now trade from the convenience of your bedroom, the coastline, or a hut in the Arctic. You get my point.

After-hours options trading involves some substantial risks. If you are determined to take it on, know a few prospective drawbacks as well as downsides.

Understandably, there isn't as much trading volume after hours as there is throughout the day. When there's much less trading task, there's less liquidity.

Liquidity refers to exactly how easy it is to trade a supply without affecting its share price too much. Throughout the day, there are numerous deals that option rates are much less most likely to change as well hugely. Yet after hrs, the scene flips. There's most likely to be a better distinction between the highest possible rate that purchasers will certainly use as well as the most affordable price vendors will certainly approve of. This can lead to unanticipated additional trading expenses.

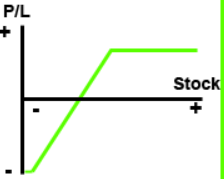

Only limitation orders are enabled when trading after-hours. At the same time, this might not be considered a significant threat for investors; you do require to comprehend its implications. After-hours options investors can just put limit orders. They don't implement it until the rate hits a specific point. If it does not, the order is canceled. When you place an after-hours order, there's constantly the chance that it won't pass.

This could be interpreted as a benefit. Limitation orders regulate financiers' losses. Lots of investors only place limitation orders, whether they trade during the day or after hrs. Feel in one's bones that an after-hours limit order might not execute, which could be troublesome.

After-hours options trading sessions are still controlled by extremely trained, seasoned capitalists. Several of them make use of after-hours trading as an extension of their company day. You'll discover a lot of institutional investors and also wealthy people in after-hours trading. You can be confident that they know what they're doing. Bear in mind that.

Reduced liquidity, as we said above, develops rate volatility. This potential threat is much more present in after-hours options trading than it is throughout the day. Another drawback is that after-hours investors see restricted pricing information. Daytime rates are set by combining the rates of a number of trading venues. When these locations close up purchase the day, after-hours traders see a limited outcome that's stemmed from less resources. It might not reflect the price that will be in location the next day.

Relying on the extended hours trading system or the moment of day, the prices shown on a certain prolonged hrs trading system might not show the rates in other simultaneously operating extended hours trading systems selling the very same safeties. Appropriately, you might obtain a substandard price in one extended hours trading system than you would certainly in an additional extended hours trading system.

After-hours trading offers a couple of distinct benefits and a great deal of dangers. In addition, the after-hours market sees more stock transactions than choices. But it's still feasible to find some rare choice opportunities in the extensive market.

After-hours trading is an option that is open to every kind and also level of investor, however it is not always the very best suitable for everybody. Investors who are much more along the lines of buy-and-hold financiers, or those making lasting financial investments, may find that after-hours trading includes unnecessary risk to their investment portfolio.

You will certainly likewise wish to see if trading outside of regular market hours is an exercise with your trading system, or if your broker performs these services. You will certainly likewise intend to check with your broker or the trading system to discover all of the regulations and policies that come with after-hours trading so that you can be certain you are following the correct treatment.

When you have established that you are prepared to embark on the globe of after-hours trading, begin with some tiny professions to obtain your feet wet and discover the process prior to spending heavily. So can you trade choices after hrs? Weigh your decision carefully. If you're still going to start, see what avenues your online brokerage firm deals for after-hours options trading.

Alternatives investors can use the after-hours trading to lock in gains or hedge making use of equities. Since alternative market hours are limited to normal trading hours, after-hours trading is a great means to both profit as well as secure earnings on anticipated information.

However, carrying out a profession after normal market hours presents fundamental threats. At this moment, it's risk-free to state the routine trading hours provide far better liquidity as well as more efficient markets. In other words, prices are a lot more reflective of fair worth.

It actually depends on a number of elements, including your danger resistance, trading technique, and whether you are going into or exiting a position. The regular financier may like to await the routine trading session, however a seasoned trader may dabble in the after-hours market to either close a losing position or obtain a get on launching a new setting. Make certain you understand about the dangers involved in trading after hours, as well as evaluate whether the benefits outweigh these dangers in your specific circumstance.

It depends upon the investor's individual preferences and also risk tolerance. Experienced investors discover that dangers such as lower quantities as well as larger bid-ask spreads are greater than balanced out by the chance to act upon brand-new details before the next day's normal trading session, along with the potential to trade mispriced safety and securities.

No, a market order can not be utilized in after-hours trading. A lot of broker agent companies only approve limitation orders in after-hours trading to safeguard capitalists from all of a sudden bad prices that may result from the reduced trading quantities and broader spreads throughout this session.

Feb 25, 2022 16:34

Feb 25, 2022 16:48