Denton Salvage

Jan 19, 2022 11:56

In this write-up, you will certainly locate just how to make use of Bollinger bands bounce trading strategy in day trading. This strategy uses two of one of the most preferred trading indications on the marketplace, Bollinger Bands as well as RSI. They are utilized to merely discover a price "bounce" that takes place throughout the main pattern.

If you have actually been looking for Bollinger band trading strategies that function, you are mosting likely to intend to pay special focus.

This unique technique educates you just how to review Bollinger Bands and Bollinger Band signals. You'll likewise learn about Bollinger Bands squeeze, double Bollinger bands strategy, Bollinger Bands tricks, and also extra. We additionally have training for the ADX Indicator.

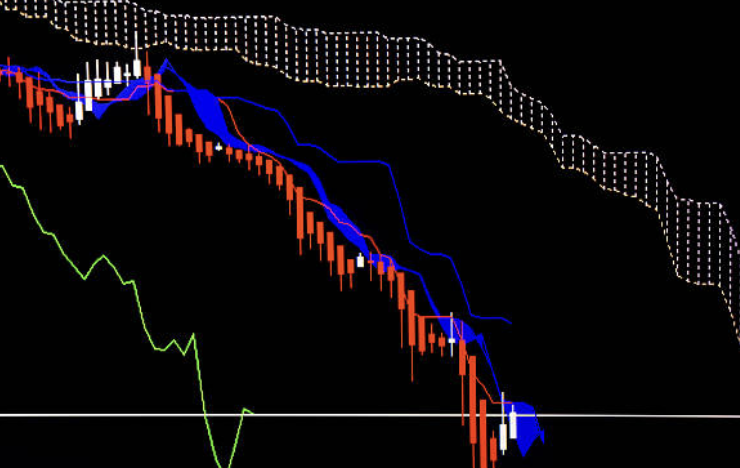

Something that will certainly appear like this:

Bollinger Bands are popular in the trading area. You can get an excellent Bollinger band formula with a simple trading method.

They were created by John Bollinger in the very early 1980s. The objective of these bands is to offer you a loved one interpretation of low and high. So in theory, the rates are high at the top band and afterwards are low at the reduced band. Bollinger Bands consist of three different lines. The upper, middle, and lower band. The middle band basically acts as a base for both the top and also reduced.

They are generally used when determining when there are overbought or oversold degrees. Offering when the cost touches the upper band and buying when the rate touches the lower band.

The spacing between the reduced, top, and middle band is figured out by volatility. The middle band consists of a 20 duration moving average. The top and also lower are 2 standard deviations below and also above the moving average in the middle. Standard deviation is a statistical action that uses an excellent reflection of the cost volatility.

When you see the band broaden that just means that there is volatility at that time. When the rate moves very bit, the band will certainly tighten which indicates that there is little volatility.

I prefer to use this trading approach utilizing the 1 hr or 4 hour time graph. You can readjust according to what style of trader you are. However the instance I will reveal you will use the 4 hr and 1 hr time chart.

Before we start taking a look at the regulations of the approach, let's have a look at Bollinger bands. Allow's see what they will certainly look like on a graph if you have never utilized this sort of sign in the past:

Let's see which indicator functions best with Bollinger Bands.

The best mix of technological indicators is the RSI-- an energy indication with Bollinger Bands-- a trend-following indication.

The Bollinger Bands RSI is an enchanting combo to time access with your favorite currency set.

After checking out the picture, it might seem a good idea to get every time the rate strikes the lower band. Or, on the other hand, market each time the cost hits the upper band. This can technically function yet is a high-risk means of trading using the Bollinger Bands. Occasionally solid patterns will certainly ride these bands as well as end up quiting out lots of regrettable traders that made use of that approach.

This is why we are making use of the RSI sign to help validate as well as trade the "bounce" of a top or a reduced band. Also, read about how lenders sell the foreign exchange market.

The RSI indicator is utilized in this strategy to see just how the currency is compromising or reinforcing..

These indicators must come conventional on your trading platform. There is no requirement to adjust these, as we will use the default settings.

I would suggest drawing a straight line on the 50.00 degree in the RSI indicator before beginning. You will discover precisely why quickly.

Trading Indicators Used with the Bollinger Bands Bounce Trading Strategy:

Bollinger Bands (20, 2).

RSI (Relative Strength Index) Indicator (14 ).

John Bollinger the programmer of the Bollinger Bands indicator advises using setups of 9-- 12 based upon a 2 standard deviation. By default the Bollinger Bands period is set at 20 and also StdDev at 2.

Nevertheless, the Bollinger Bands setups can be modified to fit your trading demands.

For instance, a scalper would certainly require to adjust the BB setups to a temporary duration. This will make the BB indicator extra sensitive to the short-term rate action.

In this instance, the very best Bollinger bands setups for scalping are 9 periods and 2 StdDev.These are also great Bollinger Band settings for 5 minute chart.

There are various methods on just how to trade Bollinger Bands from trend extension to turnaround, array trading, volatility breakouts or swing trading as well as day trading.

Using Bollinger Bands varies amongst traders relying on the trading design carried out.

If you're a day trader, you require to reconcile the Bollinger Bands on the intraday graphes. However, swing traders require to acquire low and offer high.

Yet the concern is how can day investors and also swing investors use the Bollinger Bands and both earn money?

The Bollinger Bands provide something for both traders.

The most effective swing trading opportunities generally come after the top and also reduced Bollinger bands come better with each other. When the top as well as reduced bands come closer together it implies the cost is varying.

This is commonly the result of reduced volatility.

As a basic guideline, one of the basic concepts of rate action states that low ranges are constantly complied with by big rate arrays.

This implies that when the Bollinger bands squeeze, the price often tends to make a big move in either instructions. The longer the BB capture, the greater the probability the rate will ultimately permeate one band or the various other.

Currently, here is an unconventional method to play these swing trading possibilities:.

Check out the "hooks" of the outer bands.

Let me explain:

If one band is pointing in one direction (i.e. up) the various other band should aim in the contrary direction (i.e. down) to confirm a swing trading chance.

Here's what I mean:

The swing trade entry is performed in the instructions of the outbreak.

Next off, we'll take a look at one more Bollinger bands trading approach for day trading.

A little-known technique is the dual Bollinger bands trading approach. With this trading technique, day traders can identify entrance and leaves effortlessly.

Now, you're most likely wondering:

As the name recommends the dual Bollinger bands technique makes use of 2 Bollinger bands rather than just one. This suggests that the buy and sell signals are two times extra effective.

Both Bollinger bands had the exact same duration the only distinction is the standard deviation setups:

The initial BB makes use of 2 standard deviations.

The second BB makes use of 1 standard deviation.

This indicates that we'll have 2 added bands over and also listed below the main band.

See the forex graph below:

It's crucial to understand that the majority of prices are contained within one and also 2 standard deviations.

This indicates that the price zone produced in between the 1 and also 2 standard deviations can trigger many deal signals.

This brings us to the next area.

There are 2 means one can utilize the double Bollinger Bands, which involves trading intraday turnarounds or pattern continuations.

Now, here are the regulations for trading trend reversals:

Buy if the cost trades in between the reduced 1 and also 2 standard deviations (the upper as well as lower BB demand to be flat).

Buy if the price trades in between the greater 1 and 2 standard deviations (the top and also lower BB requirement to be level).

On the other hand, if the price seems enveloped between 1 as well as 2 standard deviation and also moving upwards or downwards, we intend to sell the direction of the intraday fad.

Here is what I indicate:

In theory, Bollinger Bands will include all trading task that occurs within 2 standard deviations of the anticipated standard (the fad line).

This indicates that regarding 90-95% of cost activities will certainly happen within this range.

Bollinger Band investors are seeking circumstances of resistance and support. Circumstances of support take place when the need has become "concentrated" and a down pattern is most likely to shed momentum. On the other hand, circumstances of resistance take place when an upward fad is "condensed" and will likely turn around downward in the future.

Bollinger Bands make it simple to get reduced as well as offer high. Traders will open a position when the fad line is nearing all-time low of the Bollinger Band variety. Investors will certainly require to shut a setting when the fad line arrives of the variety.

To make it straightforward, I am going to make use of the same (GBPUSD 4-hour chart) example for each and every of these policies. This profession would certainly have been a "BUY" trade. The regulations coincide concept only the exact opposite for a SELL profession. The money remains in an uptrend and then it will pull back to the reduced Bollinger Band. From there, if it adheres to the policies, we will certainly carry out a trade.

Locating a trending market is really simple. You can utilize rate channels, pattern lines, Fibonacci lines, to establish a fad. Find greater highs or reduced lows and place a fad line on them. If the line is rising, it is an uptrend, if it's decreasing, it is a drop.

When I claim "Almost touches" an instance would certainly be something like this.

As you can see in the instance that price came all the way pull back, from the uptrend, and touched the bottom band.

The cost struck the Bollinger Band, the RSI (when the rate touches the bottom band) requires to be in between 50 and also 30. If it is not here, as well as allow's simply claim it went to the 80 mark, after that you wouldn't have an interest in trade.

You wish to see the RSI increase, in this instance, in the direction of the profession. Remember that it needs to be in between the 30-50 mark.

Once you see this motion you proceed as well as seek an entrance.

You can make an entrance when you see a STRONG BULLISH candle to the upside, consecutive reversal candle lights to the benefit, or you locate a bullish pattern forming. You require to see that the fad is moving upwards, in this instance, prior to you enter a profession.

If the candlesticks are moving to a factor where it is making a brand-new low, this would not be a great time to go into a profession. Nevertheless, once the candle lights fail to make a new low, view to see if it develops a bullish formation. Below is an example of a master candle configuration.

In this instance, I bumped to a one hr graph to make an entrance. This is flawlessly fine to do. This might offer you an extra exact area to make an entry point. As I stated, the 4 hour and 1-minute time frames are the recommended timespan for this approach. Yes, there is less of a possibility for a profession, but the signals are extremely solid when you are in a higher period.

Always remember to be placing a quit loss, and having an excellent target location. With this technique, we advise using a 30-50 pip quit.

The Bollinger Bands are a terrific sign to utilize in any market. When you integrate these with the RSI indicator, it should offer you great access points. Below is an additional method called trading volume in Forex.

Something else you can take into consideration is when the price touches the middle band. You can make a second entry to push your victors. This can potentially offer you double the earnings. With this approach, we only utilize the one trade that we initially make. However if your regulations permit you to make several professions at once with the same currency pair, after that you may consider adding a second position at the center line.

Jan 18, 2022 17:45

Jan 20, 2022 10:56