Denton Salvage

Jan 18, 2022 11:55

Today's trading method is about among one of the most reliable extension patterns, the Bear Flag Pattern. Our bear flag chart pattern technique will give you a structure to overcome the market patterns.

Our group at Trading Strategy Guides is working hard to assemble the most detailed guide on different chart pattern methods.

Among the first experiences most day investors learn when they start trading is price action trading. One of one of the most preferred rate activity patterns you may have come across is the bear flag pattern.

The bearish flag is an extremely basic extension pattern that creates after a strong bearish trend.

It does not truly matter if your favored timespan is the 5-minute graph or if you favor a long-term graph. The bear flag pattern appears with the same frequency on all time structures.

A continuation pattern, like the bearish flag, brings some excellent news due to the fact that it tells you after the marketplace has decreased, that it will certainly remain to drop a lot more.

If you missed out on the initial sell-off, the market has actually do without you, as well as you spot the bear flag pattern on that particular chart, this is an indication and also a safe place to sell so you can delight in the remainder of the bearish trend.

We're additionally mosting likely to provide you with a very clear step-by-step set of regulations so you can trade the Bear Flag graph pattern strategy by yourself.

Moving forward, we're mosting likely to discuss what makes a great bear flag pattern. We will certainly highlight five fundamental trading regulations to dominate the marketplaces with the Bear Flag graph pattern approach. You can likewise read the basic yet lucrative method.

A bear flag pattern is constructed by a descending pattern or bearish pattern, followed by a pause in the fad line or combination area. The strong down move is likewise called the flagpole while the consolidation is likewise referred to as the flag.

In other words, the bearish flag graph pattern is composed of 2 components:

Initially, the flagpole, which is constantly pointing downwards

And also, second, the flag element

Currently ...

You're possibly questioning:

"How does a bearish flag appear like?"

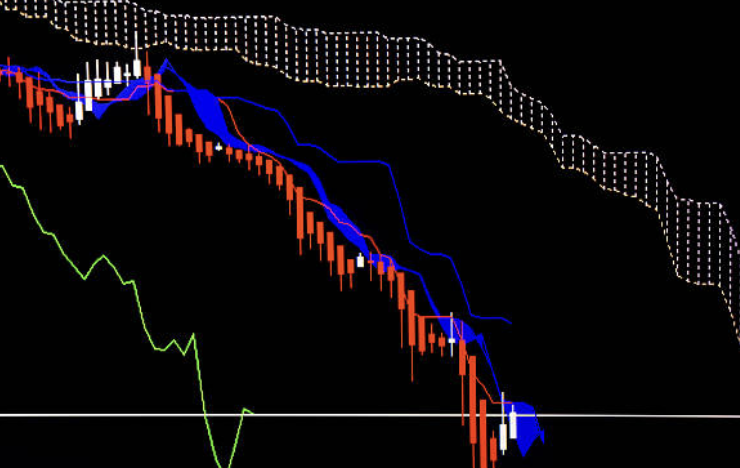

See the chart below:

The bear flag pattern comes after a solid action downwards. The stronger the step, the bigger the earnings possibility is.

As you can see in the figure listed below, after the marketplace makes a strong down move, it enters into combination-- a really slim variety-- to adapt to the brand-new reduced prices.

The bearish flag pattern has some similarities with the Rectangle Chart Pattern. The difference is within the rectangular shape pattern, the rate activity is moving flat in a much bigger trading range.

Next off ...

Let's see just how to trade the bearish flag pattern like a pro.

The prospective sell signals produced by the bear flag are straightforward.

The best trade entrance is when the price breaks below the flag.

See the bear flag example below:

The breakout of the flag signals that the downtrend prepares to resume.

Remember that the little consolidation aka the flag is a duration of time out or improvement in the bearish fad. Usually, the rate should not retrace more than 50% of the pole.

Now ...

The fact concerning trading chart patterns is that they can be found in various sizes. So, no 2 bear flag patterns will certainly look the same-- there will constantly be some small variations.

Now, when the rate moves in the opposite instructions-- suggesting the flag pole is pointing upwards, we have the bull flag chart pattern, which is the opposite of the bear flag.

See below the distinctions between the bull and bear flag formations.

A bull flag is similar to a bear flag other than the pattern instructions is up.

The favorable flag developments can be recognized by a solid uptrend followed by a pause in the fad that has the shape of a flag.

See the bull flag pattern instance listed below:

So, you just shake up the bear flag and also you obtain the bull flag.

If you wish to learn just how to trade the bullish flag pattern like a pro, please check our guide.

Moving forward ...

Let's see when the very best time to trade the bear flag is.

The optimal time to trade the bear flag wants the cost breaks an assistance level.

The standard approach of trading outbreaks of support and also resistance degrees is to sell as quickly as we break listed below support and also buy as quickly as we break the resistance level.

This trading strategy is not without imperfection.

Let me clarify:

Going after prices lower after a breakout wishing to catch a piece of the action is always a negative suggestion, for several factors.

First, you take the chance of offering the low of the day, due to the fact that you're selling after the price has actually already relocated dramatically reduced. And also, second of all, the danger to award ratio of such professions is constantly altered versus the investor.

So, you have 2 solid factors not to take the breakout.

If you still wish to maximize the volatility that arises from a breakout, a far better strategy is to wait for the bear flag to appear on the cost graph.

See the chart below with an instance:

The bear flag development supplies trades with encouraging risk-reward ratio and also clear entry and also leave points.

Now, the downside is that you're mosting likely to miss some of these outbreaks if the bear flag doesn't establish on the cost chart.

In this situation, you can always use this breakout trading strategy as well as uncover exactly how the pros trade breakouts.

In the following area, you'll uncover what is going on behind the scene.

Continue reading ...

The bear flag pattern highlights a trading setting where the supply and also need balance has changed badly in one instructions of the marketplace (supply > demand). Consequently, this will certainly generate really little upside retracement, which permits the flag structure to materialize.

After the initial selloff, individuals that missed out on the train will certainly worry and begin offering. Even more individuals will certainly market it throughout the flagpole phase.

Throughout the time out or the slim loan consolidation, people wait to obtain a higher rate so they can offer. But because the supply and need equation is so imbalanced, this won't take place. We get another hit that will certainly make many individuals chase after the move to the drawback once again.

Now, let's see how you can properly trade with the Rectangle chart pattern technique and also exactly how to make benefit from basically utilizing nude charts. You can also review quit loss forex for much better trading.

Now that you're familiar with the bearish flag formation, allow's go through a simple detailed guide. It will certainly frame a simple trading technique for you to skim the marketplaces.

The best aspect of the bear flag pattern is that there's an extremely simple means of knowing how low it will send out the currency rate.

We've done something different with the Bear flag chart pattern technique. We're mosting likely to educate you a new means on just how to trade the bearish flag.

Now is the moment to go through the bear flag graph pattern approach detailed overview:

Just because you can identify the bear flag pattern, does not imply you have to leap directly into the market and also trade it.

Remember, we need the best context and the best rate structure requires to align for a tradable bearish flag.

So, the initial step is to determine the market pattern prior to the flag price formation.

First, a valid bearish flag requires a sharp decline. This is strong proof of a bearish trend and that the supply and also demand is out of balance.

Keep in mind The sharp move is also the Flagpole-- the first component of the bearish flag structure.

The flag cost formation is the 2nd aspect of the bear flag pattern.

Generally, all you require to do is to spot one assistance as well as one resistance degree. It must include the cost activity in a very slim array.

The slim range is key for the bear flag pattern success rate.

Thus far, so good.

Currently, we require to establish an access method for our bear flag pattern strategy.

See below:

After we determine the market pattern and also the attributes of an excellent bearish flag pattern we need to wait on confirmation that the trend will return to.

There are two basic strategies to go into the marketplace with the bear flag pattern. Hostile investors will certainly get in on top of the bearish flag as this will certainly secure a little bit of bigger profits.

If you're a traditional investor you can wait on confirmation given by the flag breakout.

Our team at TSG likes to take the traditional strategy as well as wait on a break as well as close listed below the bearish flag prior to performing the profession.

The bear flag chart pattern technique just looks for trading chances when you get an outbreak listed below the flag price structure to be a vendor.

The following essential point we require to establish is where to position your safety quit loss.

It is essential when looking at this sort of method to maintain every little thing in the context of the general market. Way too many investors will try to zoom on

See below ...

The Rectangle chart pattern method offers you a simple means to quantify threat because you can place your safety stop-loss a little over the flag rate framework.

We're accomplishing 2 points with our tight quit loss:

1. Tiny losses.

2. Greater threat to reward ratio.

With such a tight quit loss you'll have the convenience of losing numerous trades in a row due to the fact that with the amazing RR the bearish flag can possibly erase all your losses in a solitary profession and still come rewarding.

The next sensible point we require to establish for the bear flag pattern approach is where to take revenues.

See below ...

The book profit target is the height of the flag post gauged down from the top of the flag.

Our team at TSG has actually found out that the market likes this sort of cost proportions as well as we such as to benefit from it.

Jan 17, 2022 10:00

Jan 18, 2022 17:45